Tax pros and cons of family investment companies

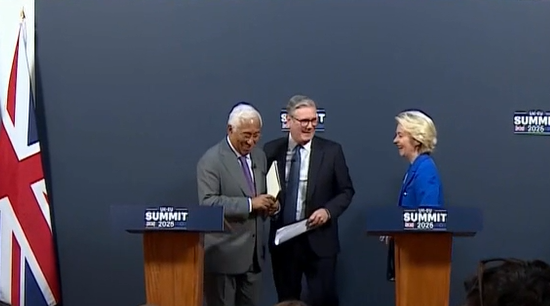

Chris Etherington, CTA ATT, tax partner, RSM

Many business owners are considering making gifts during their lifetime, rather than through their will due to changes to business property relief, but does this make tax sense, asks Chris Etherington, partner at RSM

One of the consequences of the Autumn 2024 Budget announcements on inheritance tax (IHT) is that many families are now considering passing assets on to the next generation sooner than they might have otherwise planned.

An increasingly popular answer to this problem is the family investment company.

The changes to business property relief and the impact on IHT liability is causing a dilemma for some business owners who want to retain some control, and ensure any gifts are invested wisely.

This will commonly involve parents making gifts to their children, and in many of these scenarios, there are concerns about how to make such gifts while maintaining some control over these assets during the parents’ lifetime.

That might be due to concerns about protecting the family’s assets over the longer-term, particularly in the case of a child getting divorced in the future. Or it might simply be a question of maturity, and not wanting to place significant funds directly into a child’s bank account.

Historically, trusts were the preferred solution for this issue. However, trusts have become more challenging for some individuals passing wealth to the next generation, due to potential upfront tax charges that can result in a 20% IHT liability, particularly on larger gifts into a trust.

As a result, the use of trusts has steadily declined since 2006, while in our experience, the use of an alternative vehicle, the family investment company (FIC), has increased.

FICs are essentially companies that hold a family’s long-term investments, including share portfolios or rental property. Some families are now looking at whether it makes sense for a FIC to hold shares in a family trade as well, given that full IHT relief on trading company shares will be restricted for many from April 2026.

A typical FIC, which will just hold investments, is usually funded by subscribing for shares or making loans. These shares and loans are typically held by the children and other family members so they can benefit from the FIC in the future.

Parents often retain some shares to maintain control over the FIC and, as board members, they can make investment decisions and determine when amounts are distributed to shareholders.

A FIC can replicate some advantages of a trust by allowing assets to be effectively gifted to family members through the shares and loans, while retaining control during the parents’ lifetime.

From an IHT perspective, this is efficient, as it can remove value from the parents’ estates, which might otherwise be subject to 40% IHT, although this liability is transferred to another family member.

While this might be seen as a deferral of IHT, a key benefit is that no upfront 20% IHT cost arises, as it can with a gift to a trust.

Holding investments in companies can also be tax-efficient, since companies generally do not pay corporation tax on dividends received from shares held. Plus, there is a significant difference between income tax rates (up to 45% in England, Wales and Northern Ireland) and corporation tax rates (up to 25%).

That said, the benefits of a FIC need to be balanced against the costs of operating such a company, and the tax rules associated with a FIC can be quite complex, so they will not be appropriate for everyone.

It’s therefore important that families review all their options carefully when considering how to transfer wealth across generations, and FICs may play an important role in facilitating this.